TAKE ADVANTAGE OF FINANCIAL BUSINESS INTELLIGENCE SOFTWARE

Financial Planning and Analysis

Financial Planning and Analysis

Expense Management

Expense Management

Revenue and Profitability Management

Revenue and Profitability Management

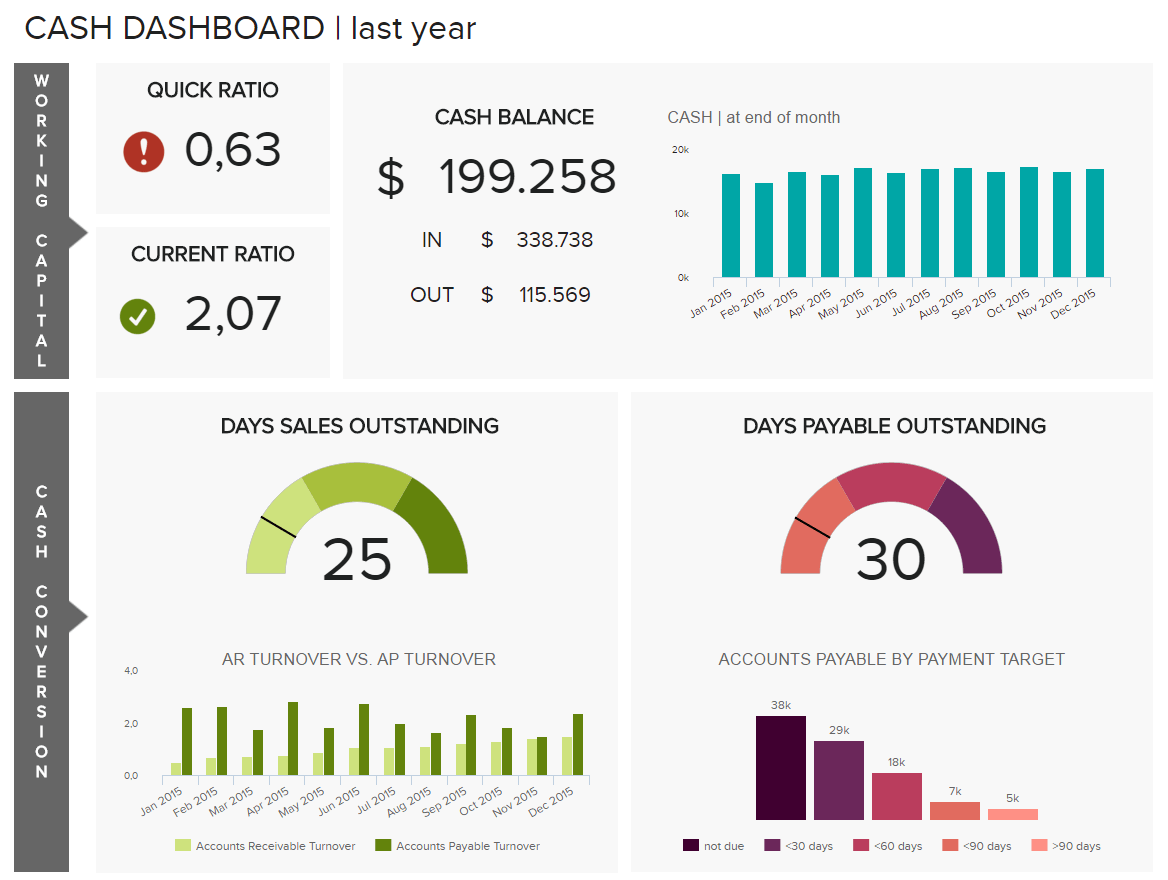

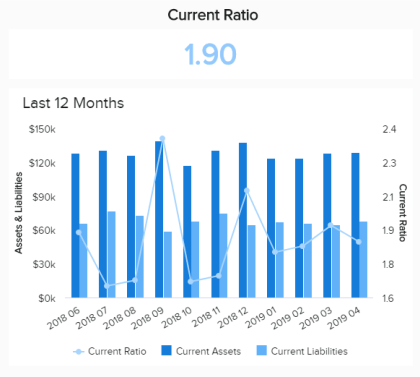

Cash-Flow and Balance Sheet Management

Cash-Flow and Balance Sheet Management

Become a data wizard within less than 1 hour!

CHECK OUT STUNNING FINANCIAL BUSINESS INTELLIGENCE EXAMPLES

WHY IS FINANCIAL BUSINESS INTELLIGENCE SOFTWARE SO IMPORTANT?

Whether you’re a C-level executive or financial manager and professional, having the right data and full control over the financial health of your company is essential in today’s competitive environment. A vital component to ensure financial stability is knowing exactly where cash flows, continuously optimising expense management and ensuring profitable results at all times. Not just the responsibility of CFOs, but finance managers and professionals alike, finance business intelligence enables a data-driven culture on all levels. If strategies and operational efforts are done with the help of a modern financial dashboard created with professional software, the continuous growth of a company is guaranteed.

Financial data is usually scattered throughout departments and spreadsheets that represent an additional challenge when this data needs to consolidate and act as a stable roadmap of a company. Modern financial business intelligence software serves as a backbone for any professional that needs to gather, analyse, and monitor this information to keep the company agile, focused on issues at hand and provide 100% correct data at all times. That’s why having professional software is so important because, without it, constant manual work will certainly cause errors.

FINANCIAL BUSINESS INTELLIGENCE BEST PRACTICES

Translating numerous spreadsheets and gaining insights through a single screen is becoming a crucial element in today’s fiscal management and processes of a company. The ability to correctly and without manual interference create compelling reports or utilise real-time data when there is no time to export additional files and generate actionable insights, will present itself as one of the most invaluable resources a company can obtain. To do this in the best possible manner, there are certain best practices you can adopt. Consider the audience you’re going to present your data as the first crucial step in creating the best possible BI in finance presentation and processes. If your data needs to be presented to a C-level executive, a professional or simply to a colleague from another department that needs to be informed about your department or goals, the numbers on the screen will certainly be different.

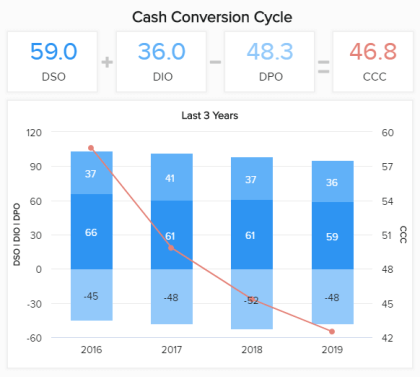

That will take you to select the right financial KPIs. Whether you need to track the accounts payable turnover, working capital, cash conversion cycle or budget variance, the combination of metrics will generate a data-story that even non-finance partners could understand and compare with their own processes. This will increase the communication quality between colleagues and create a more simple approach to complex financial information. After selected metrics are consolidated, creating a dashboard that will enable users to compare their results in different time periods, interact with each metric on the screen or schedule automated reports will decrease numerous hours that were previously used for manual extraction and manipulation of data. This way, identifying patterns and potential concerns can be addressed quickly and without bottlenecks. BI for finance safeguards all processes and acts like an assistant that will enable teams to focus on results instead of losing themselves in hundreds of rows while risking misinterpretation of important financial information that could lead to serious business issues. These best practices can make your business smarter, faster, and focused on performance while completely eliminating tedious manual labour.

PREDICT YOUR FUTURE WITH BUSINESS INTELLIGENCE FOR FINANCE

Business intelligence in finance brings one thing that no other method of analysing data can ensure: predicting the future. You can suggest how financial data will look like based on educated guesses, but the point here is that professional business intelligence for financial services offers a simple and intuitive drag-and-drop interface that will also help predict what will happen in the future. By simply selecting past and current data points, and the model quality, the software can automatically calculate future financial data that can act as a roadmap on what to expect so you can properly prepare yourself and act accordingly. These predictive analytics models were often done exclusively by designated analysts or statisticians, but modern software enabled the democratisation of this data while helping financial staff to better target revenue-generating operations and streamline the whole business with a more intelligent allocation of financial resources.

The future of the economic health of a company lies within the possibility to implement top financial services’ business intelligence, where smart solutions such as datapine will support all your financial efforts and equip you with modern technologies that will increase your efficiency.

Become a data wizard within less than 1 hour!